The markets are unpredictable—but your process doesn’t have to be.

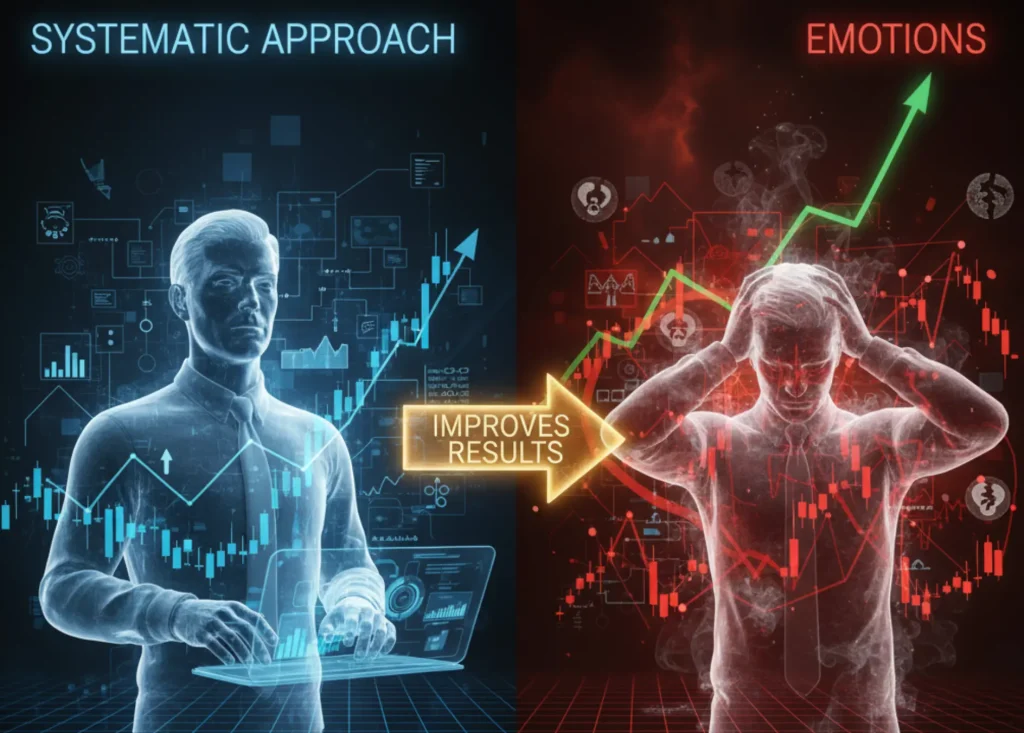

One of the greatest advantages of a systematic investing approach is that you don’t need to predict the future. You don’t have to constantly wonder which stocks to hold, when to buy or sell, or whether it’s the right time to hedge. Instead, you follow a set of proven rules and criteria, reducing guesswork and emotional decision-making.

This shift—from relying on intuition to relying on process—can transform an investor’s performance.

Why Emotions Are a Challenge for Investors

Ask any investor and they’ll tell you: emotions often get in the way of good decisions.

- Fear makes investors sell too soon.

- Greed makes them hold on too long.

- Uncertainty makes them hesitate when opportunities arise.

It’s impossible to eliminate emotions entirely—we’re all human. But by relying on systematic processes, you can limit their influence and stick to a more objective path.

From Guesswork to Rules-Based Investing

Early in my career, I often traded based on what I thought the market might do next. Like many others, I felt uncertain and second-guessed myself constantly.

The turning point came when I began incorporating mechanical systems into my process. By creating clear rules for stock selection, entry, and risk management, I reduced the role of guesswork and emotional bias in my results.

The improvement was immediate. With systems in place, decisions became faster, clearer, and more consistent.

How My System Works

My process combines both fundamental analysis and technical momentum signals, separated into two distinct steps:

1. Building the Watchlist

First, I create a watchlist of stocks using fundamental criteria. These include:

- Strong company performance

- Solid financial health

- Business models with long-term growth potential

This ensures that every stock I consider has a sound foundation.

2. Applying a Momentum-Based System

From there, I use a momentum-driven technical system to determine which of those watchlist stocks qualify for entry into my portfolio.

This step ensures that even if I like a company’s fundamentals, I don’t buy it automatically. The final decision is mechanical, not emotional—a critical safeguard against personal bias.

The Benefits of Systematic Decision-Making

This structured, two-step approach has delivered several advantages:

- Reduced bias: I no longer buy just because I “like” a company.

- Clear rules: Each decision follows predefined criteria.

- Consistency: My portfolio evolves systematically rather than randomly.

- Emotional control: By automating entries, I avoid panic or hesitation.

Simply put, the system decides—emotions don’t.

Hedging with Protective Puts

While my stock-selection process is fully systematic, I also maintain clear rules for hedging.

- When I see the market looking overextended in the short term, I buy protective puts on index ETFs.

- These puts act like insurance, limiting my downside risk if a correction occurs.

- This approach means I don’t need to predict the exact timing of a downturn—I just ensure I’m covered when risks appear elevated.

This combination of systematic entries and rules-based hedging gives me confidence to stay invested, knowing my downside is contained.

Turning Rules into Routine

Start by writing a one-page rulebook. Define your investable universe, the exact entry criteria (fundamental thresholds plus a momentum trigger), position sizing (e.g., risk 0.5–1% of equity per idea), and exit rules (trend break, thesis break, or time stop).

Add a small hedge budget—a fixed percentage of portfolio value you’re willing to spend on protective puts during overextended markets. When rules live on paper, you’re far less likely to improvise under stress.

Before committing fully, forward-test your system. You don’t need fancy software: track signals in a spreadsheet for 8–12 weeks, as if you traded them, and record win rate, average gain/loss, max drawdown, and time in market.

Avoid touching the rules every time a trade disappoints—that’s how overfitting starts. You’re testing the process, not chasing perfection. If the live feel matches your expectations from past observations, scale gradually.

Execution is where emotions creep in, so build friction-reducing habits. Refresh your fundamentals-based watchlist on the same day each week.

Set automated alerts for your momentum trigger instead of screen-watching. When a signal fires, deploy a pre-set tranche and pair it with your hedge rule if short-term risk looks elevated. No debating, no narratives—just follow the checklist. Consistency beats conviction when the tape gets noisy.

Close the loop with a lightweight review cadence. Monthly, note which rules you followed, where you deviated, and why. Quarterly, consider one surgical tweak at most—like nudging the momentum threshold or refining your exit lookback—only if your journal shows a repeatable pattern.

The goal isn’t to find a magic setting; it’s to iterate without drifting, so the system remains simple enough to run—and strong enough to trust.

Related Reading: Building a Smarter Investment Framework

If you want to learn more about disciplined investing, check out these related articles:

- Fundamentals Matter—But So Does Price – Why combining fundamentals and price action creates stronger strategies.

- Reviewing a Year of Investing: Why Reflection Is Key to Long-Term Success – How annual reviews improve strategy and mindset.

Final Thoughts

The beauty of a systematic approach is that you don’t need to predict the future—you only need to follow your process.

By blending fundamentals, momentum signals, and protective hedges, you reduce emotional interference and improve your odds of long-term success.

So let me ask you:

Have you built a mechanical system for your investing, or are emotions still influencing your decisions?

Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, investment, or legal advice, and should not be taken as a recommendation to buy, sell, or hold any asset. Always conduct your own research and consult with a qualified professional before making any financial decisions. The author and publisher are not responsible for any actions taken based on the information provided in this content.