Market volatility is one of the biggest challenges every investor faces. Stock prices can swing dramatically from one day to the next, and these fluctuations can cause anxiety, panic selling, and poor decision-making.

But here’s the truth: volatility is unavoidable. And if you know how to manage it, you can turn it from a threat into an opportunity.

In this guide, I’ll share my personal approach to handling market turbulence and outline practical strategies that can help you invest with confidence.

What Is Market Volatility?

Market volatility refers to how much and how quickly the price of an asset changes over time. High volatility means big, frequent price swings, while low volatility means prices move more steadily.

Volatility is often measured by the VIX Index (sometimes called the “fear gauge”), but for most investors, it’s more about how those swings feel in their portfolio, and how they respond to them.

1. Understand Your Psychological Profile

Your ability to handle volatility starts with knowing yourself. Risk tolerance is a mix of personality, past experiences, and even genetics. Some people thrive in high-risk environments, while others prefer stability.

A higher risk tolerance can lead to higher potential returns, but without proper risk management, it can also result in big losses. For example, using leverage (borrowing money to invest) can magnify gains but also amplify losses if the market moves against you.

Key takeaway: Don’t fight your nature. Build an investment strategy that matches your comfort level with risk.

2. Adjust Risk to Your Life Stage

Your life stage plays a huge role in how much risk you should take:

- Young professionals with stable incomes and few obligations can often take on more volatility because they have time to recover from downturns.

- Pre-retirees and retirees may want to reduce exposure to risky assets to protect their savings, even if they have accumulated significant wealth.

Your age, financial responsibilities, and goals should guide how much of your portfolio is in volatile investments versus stable, income-generating assets.

3. Invest in What You Understand

Knowledge is one of the best defenses against volatility-related mistakes. There are two parts to this:

a) Knowledge and Risk Management Tools

Understanding how to limit downside risk is essential. Strategies like protective puts (an options contract that allows you to sell an asset at a fixed price) or hedging can help shield your portfolio from steep declines.

These techniques are accessible to everyday investors but require a basic understanding of financial markets.

b) Confidence in Your Investments

When you know the fundamentals of an asset and believe in its long-term value, it’s much easier to stay calm during short-term price swings. This confidence helps you avoid panic selling at the worst possible moment.

4. Manage Your Perception of Profit

The way you view your gains affects how you react to losses.

For example, early Bitcoin investors who bought below $10,000 often see their gains as “house money”, profit they can afford to risk. As a result, price drops don’t bother them as much.

However, with new investments, volatility can feel more stressful because the money is still perceived as your original capital, not profit.

Personally, I prioritize protecting my initial investment. Once I secure a meaningful gain, I treat that profit as real money. This mindset prevents me from taking reckless risks with what I’ve already earned.

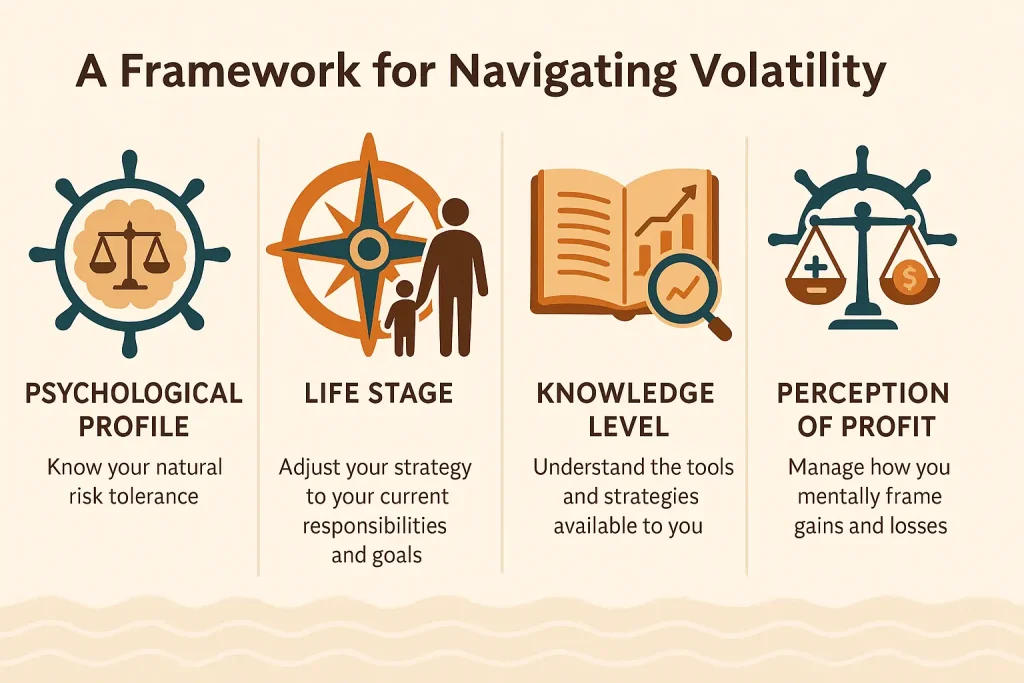

5. A Framework for Navigating Volatility

To invest confidently in volatile markets, anchor your plan to four factors that don’t change with every headline—and spell out what each means in practice.

- Psychological profile: Be honest about your natural risk tolerance. If a 10–15% drawdown makes you lose sleep, size positions smaller, keep a cash buffer, and use protective puts during stressed periods. If you tolerate swings better, you can run higher equity exposure—but still define a maximum loss per position (e.g., 0.5–1% of portfolio) so one mistake never sinks the ship.

- Life stage: Match risk to responsibilities. Early career investors can prioritize growth and accept volatility because time is their ally; parents with dependents or near-retirees should emphasize capital preservation, steadier income (dividends, covered calls), and tighter risk controls. Revisit this annually—your allocation should evolve as your life does.

- Knowledge level sets the ceiling for complexity. If you’re newer, keep the toolkit simple: diversified funds, clear contribution schedules, and a basic rebalancing rule. As your competence grows, layer in defined-risk tactics—like protective puts around event risk or rules-based momentum entries—without turning your portfolio into a science project. The test is operational: can you explain each rule in one sentence and execute it in minutes? If not, simplify.

- Perception of profit shapes behavior more than spreadsheets. Losses feel roughly twice as painful as equivalent gains (loss aversion), so predefine what a “normal” pullback looks like for your strategy, and use checklists to avoid panic-selling. Rename outcomes to reduce noise: “trade within plan,” “trade outside plan,” and “needs review.” You can’t mute emotions, but you can outvote them with structure.

Related Reading

For a deeper dive, see :

- Identifying Future Market Leaders During Corrections – how fundamentals plus relative strength help you spot the stocks that hold up best and lead the next uptrend

- Hedge Fund Managers’ Pessimism vs. A Market Full of Opportunity – why gloomy sentiment can coexist with compelling setups—and how to position without fighting the tape)

- How Much Control Do You Really Have Over Your Stock Investments? practical ways to define risk upfront with protective puts and disciplined entries so emotions don’t run your portfolio

Final Thoughts: Turning Volatility into Opportunity

Volatility isn’t your enemy. It’s simply part of the investment landscape. With the right mindset and strategies, you can use it to your advantage instead of letting it control your decisions.

Investing successfully in volatile markets comes down to self-awareness, education, and discipline. By building a portfolio that matches your personality, life circumstances, and financial goals, you can navigate market swings with confidence.

Disclaimer: This article is for informational and educational purposes only. It does not constitute financial, investment, or legal advice, and should not be taken as a recommendation to buy, sell, or hold any asset. Always conduct your own research and consult with a qualified professional before making any financial decisions. The author and publisher are not responsible for any actions taken based on the information provided in this content.