Some people seem to have a natural ability to see the future of markets before everyone else. They spot opportunities while others are still doubting, and they avoid pitfalls before they become obvious. This is not luck. It is a skill called pattern recognition.

In investing, the ability to connect the dots can mean the difference between watching history happen and shaping it.

What Connecting the Dots Really Means in Investing

Connecting the dots is the ability to recognize patterns and trends. It is noticing something happening today that resembles events from the past and drawing conclusions based on those similarities.

For example, someone who saw the early rise of smartphones might have remembered how the internet changed business in the 1990s. By recognizing the pattern, they could predict that mobile technology would transform entire industries.

This skill is not about predicting the future out of thin air. It is about seeing signals others overlook because they do not recognize the shapes those signals take.

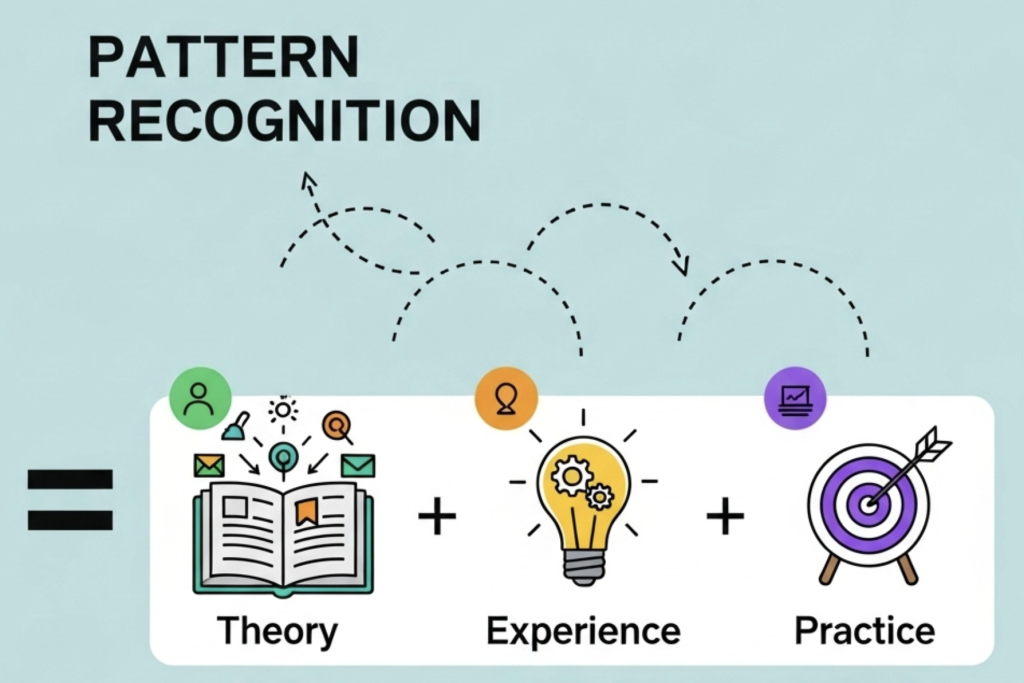

The Three Essential Elements of Pattern Recognition

Pattern recognition does not come from guesswork. It is built on three pillars that work together.

- Theory

This is your foundation. Without a solid understanding of economic principles, market structures, and basic financial concepts, you will not be able to interpret what is happening. Theory explains the rules of the game. - Experience

Experience means seeing markets react to different situations over time. It is living through booms, busts, recoveries, and periods of stability. Each event leaves an imprint that makes the next similar situation easier to understand. - Practice

Practice turns theory and experience into something you can use in real time. The more you engage with the market, study charts, and observe trends, the faster you will recognize when a familiar pattern appears again.

Think of a musician. They learn music theory, play in different situations, and practice for hours. Eventually, they can play almost instinctively. Investors develop their skill in a similar way.

Why Human Behavior Creates Repeated Patterns

Markets are driven by people, and people are driven by emotions. Fear, greed, optimism, and pessimism repeat again and again, shaping the movement of prices.

When optimism runs high, prices tend to rise quickly. When fear takes over, they can fall just as fast. This rhythm creates recognizable patterns in charts, which is why technical analysis works.

Technical analysis is the study of price charts to identify these recurring shapes. While it may sound complicated, at its core it is about recognizing that human behavior has not changed for centuries, and therefore, certain market movements tend to repeat.

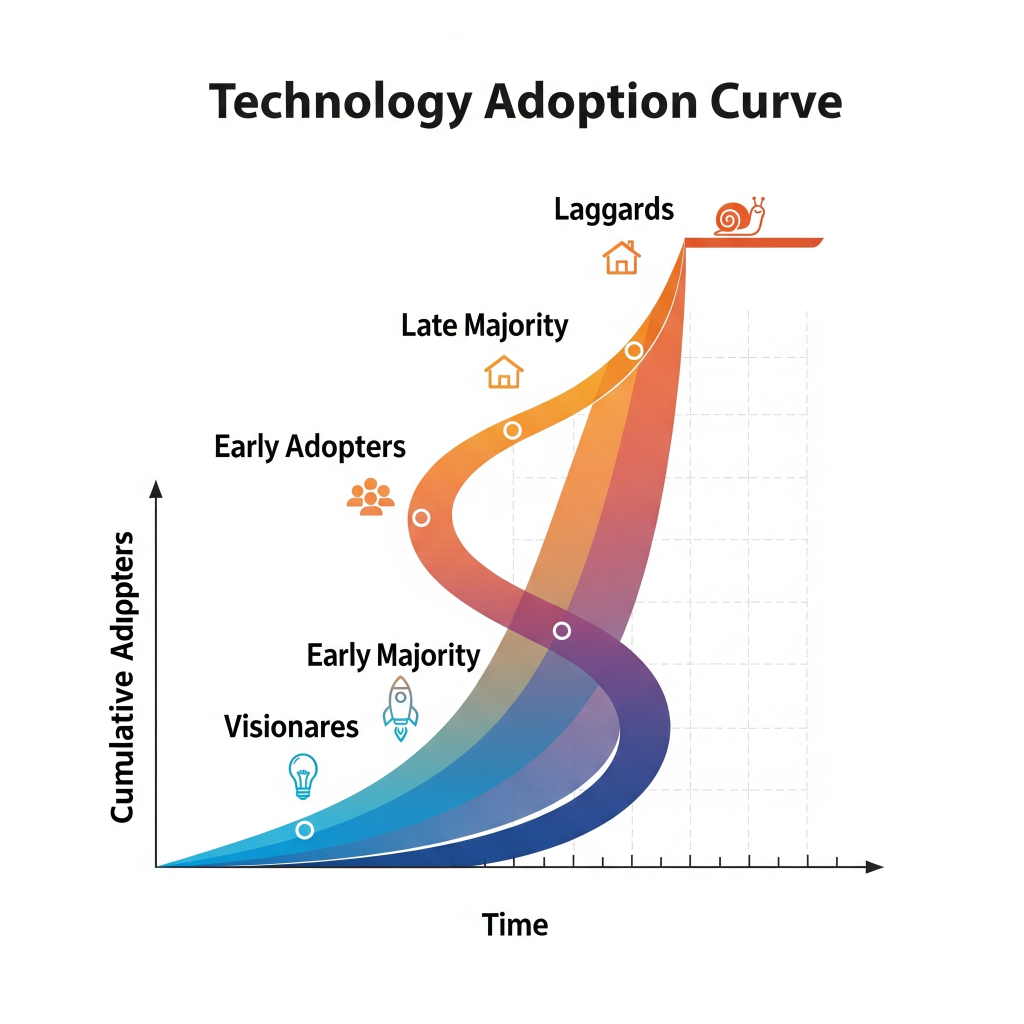

The Technology Adoption Curve

New technologies follow a predictable adoption pattern. First, a small group of visionaries sees the potential long before anyone else. Then, the early adopters join in, eager to try something new. Next, the early majority arrives once the technology proves useful, followed by the late majority who are slower to change. Finally, the laggards adopt it only when they have no choice.

A good example is online shopping. Not long ago, many people insisted that buying with a credit card on the internet was unsafe. While fraud exists, the benefits of convenience, speed, and choice gradually won people over. Today, digital payments are so common that in many cases they are required.

Bitcoin: From Skepticism to Widespread Use

Bitcoin has followed a similar path. At first, only a small group of technology enthusiasts saw its potential. Then came early adopters who recognized it as a store of value and a new form of money.

Over time, skeptics began to reconsider. People who once refused to own or use Bitcoin are now more open to it. The adoption curve is still unfolding, and we have not yet reached the stage where using digital assets is nearly unavoidable.

This is another example of how connecting the dots can reveal where the future is heading before it becomes obvious.

AI: The Next Transformative Wave

Artificial intelligence is now at the point in its curve where many people still see it as unnecessary. Some do not understand why they would use tools like ChatGPT or Claude. Yet the potential impact of AI on daily life is likely to exceed that of the internet or the smartphone.

The shift will be massive. Jobs will change, industries will evolve, and entirely new roles will appear. Those who do not learn to work with AI will find it increasingly hard to compete in the modern workplace.

History suggests that the same pattern will play out here: visionaries and early adopters will lead the way, while the majority will follow once the benefits are undeniable.

AI and Crypto Growing Together

It is not just AI alone that will shape the future. Cryptocurrency and blockchain technology are likely to grow alongside it. Bitcoin may serve as a form of digital gold, while stablecoins and decentralized finance could power new systems for payments, contracts, and trade.

Imagine AI systems that can interact directly with blockchain networks to process transactions, verify data, or manage supply chains automatically. This combination could redefine how businesses operate and how individuals interact with financial services.

Entirely new professions may emerge to help people and companies adapt to these tools. Specialists who combine expertise in AI with knowledge of blockchain could become as important as web developers were in the early 2000s.

Conclusion and Reflection

Pattern recognition is more than a skill for investors. It is a way of looking at the world. The same forces that shaped the past will influence the future, and the clues are often right in front of us.

From credit cards to Bitcoin to AI, the path from skepticism to necessity is one we have seen before. The question is not whether change will come, but whether you will notice it early enough to understand its impact.

The patterns are already forming. Will you recognize them when you see them?

Disclaimer:

This article is for informational and educational purposes only. It does not constitute financial, investment, or legal advice, and should not be taken as a recommendation to buy, sell, or hold any asset. Always conduct your own research and consult with a qualified professional before making any financial decisions. The author and publisher are not responsible for any actions taken based on the information provided in this content.